You may have the right idea, but you may still lose.

It always fascinates me how certain well understood and economically justifiable anomalies tend to correct themselves in very sudden and unexplainable manners. It’s the kind of stuff that mesmerises analysts and makes the fortunes of ‘star investors’ who were simply in the right place at the right time (more succinctly, plain lucky).

A classic case is the evolution of the story around the subprime crisis of 2007-2009. Signs of distress coning from subprime borrowers were evident far earlier. Hosing prices on a national scale peaked in the fourth quarter of 2005. Given this information was public and widely known, investors that could take advantage of a decline in prices of all related variables, including subprime credit-based investment vehicles, did build positions in the market to that effect. But they mostly ended up losing a lot of money just because their views took too long to pan out. Only in mid 2007, a year and a half after the beginning of the decline in home prices, signs of serious distress emerged building up to the failure of Bear Stearns and ultimately leading to the catastrophic bankruptcy of Lehman Brothers in September of 2008. John Paulson made his name and fame on the trade (shorting sub-prime loans and vehicles), on the skeletons of many of his colleagues and competitors. Was he really that much smarter or simply super lucky (I think the latter, but I maybe biased)? How and why did the mess come to a head just at the time it did? News? Politics? Change of season?

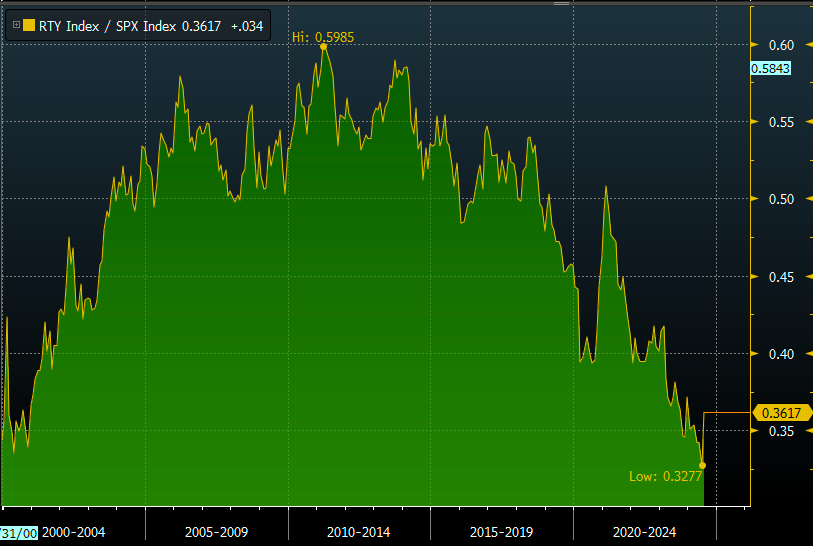

The most recent variation on the theme is the renewed interest and associated over performance of small caps. The recent rally has been nothing short of phenomenal, specially in the context of the beating witnessed in the large cap and tech sectors. All sorts of theories are jumping up to explain this evolution of prices, none of which really stands on its own (possible second Trump admin, the dollar, interest rates coming down, etc). Looking at the graph above (when the line goes up, small caps are outperforming large caps in total return terms, and vice versa), you can see we went through many of these factors in the last 25 years and yet the relationship with large caps is pretty much independent of all of them. Can you spot the ‘Trump effect’, one of the most quoted reasons for the small cap outperformance today? I bet you can see much more clearly the ’Biden effect’, between end of 2020 and the first quarter of 2021. An argument that I can understand better is the disparity of valuations that has materialised overt the past 15+ years, but we all know valuation may count in the longer term, not in the immediate future. As in the case of the sub-prime denouement I suppose we will never really know. But rest assured that fortunes will be made, new ‘star investors’ will pop up and we shall be no wiser than before.

[Sources: Bloomberg; author's calculations]

It always fascinates me how certain well understood and economically justifiable anomalies tend to correct themselves in very sudden and unexplainable manners. It’s the kind of stuff that mesmerises analysts and makes the fortunes of ‘star investors’ who were simply in the right place at the right time (more succinctly, plain lucky).

A classic case is the evolution of the story around the subprime crisis of 2007-2009. Signs of distress coning from subprime borrowers were evident far earlier. Hosing prices on a national scale peaked in the fourth quarter of 2005. Given this information was public and widely known, investors that could take advantage of a decline in prices of all related variables, including subprime credit-based investment vehicles, did build positions in the market to that effect. But they mostly ended up losing a lot of money just because their views took too long to pan out. Only in mid 2007, a year and a half after the beginning of the decline in home prices, signs of serious distress emerged building up to the failure of Bear Stearns and ultimately leading to the catastrophic bankruptcy of Lehman Brothers in September of 2008. John Paulson made his name and fame on the trade (shorting sub-prime loans and vehicles), on the skeletons of many of his colleagues and competitors. Was he really that much smarter or simply super lucky (I think the latter, but I maybe biased)? How and why did the mess come to a head just at the time it did? News? Politics? Change of season?

The most recent variation on the theme is the renewed interest and associated over performance of small caps. The recent rally has been nothing short of phenomenal, specially in the context of the beating witnessed in the large cap and tech sectors. All sorts of theories are jumping up to explain this evolution of prices, none of which really stands on its own (possible second Trump admin, the dollar, interest rates coming down, etc). Looking at the graph above (when the line goes up, small caps are outperforming large caps in total return terms, and vice versa), you can see we went through many of these factors in the last 25 years and yet the relationship with large caps is pretty much independent of all of them. Can you spot the ‘Trump effect’, one of the most quoted reasons for the small cap outperformance today? I bet you can see much more clearly the ’Biden effect’, between end of 2020 and the first quarter of 2021. An argument that I can understand better is the disparity of valuations that has materialised overt the past 15+ years, but we all know valuation may count in the longer term, not in the immediate future. As in the case of the sub-prime denouement I suppose we will never really know. But rest assured that fortunes will be made, new ‘star investors’ will pop up and we shall be no wiser than before.

[Sources: Bloomberg; author's calculations]