Then came the 1970s. Early in the decade John McQuown created the first index fund at Wells Fargo and in 1976 John Bogle offered individual investors an index fund that tracked the S&P 500 Index. As we know, the following decades saw an expansion of the use of index products to the point where today, depending on the asset class or sector, they account for a substantial ‘minority’ of all invested funds.

The success of index products is easy to understand. In fact, one has to wonder why it took so long for them to become the vehicle of choice for many investors, and what are the remaining non-converts doing with their money. We’ll come to that a little later. The essential reason index products were successful is that they managed to give diversification and access to appropriate investment vehicles to practically all investors, at a minimal cost. A mere $100, for example, buys you a participation in the most diversified global equity portfolio (through an ETF replicating returns of the MSCI All-Country World Index). True, that still leaves the asset allocation issue pending, but in the meantime you solved almost everything else at a cost which is a fraction of what you needed to spend before McQuown and Bogle came along.

What, then, are the remaining active investors and managers thinking? I don’t know for a fact, but I can list a few possibilities. The first is pure and simple job justification: can you imagine how many people would be unemployed if every institutional investor went ‘passive’? Same story on the investment management industry side, which is why they are waging an epic fight to retain what they can of the truly enormous fees by inventing ‘asset classes,’ pushing investors towards private markets, complicating the performance measurement methods used, and sometimes even raising fees when they hit one or two years of good (likely random) performance. There’s also the entertainment factor at play: passive investments are very efficient but also very boring (you buy them and then you periodically re-balance your holdings; that’s it) whereas stock picking keeps you very busy and gives you something to talk about. Unawareness of historical returns and what active management has produced over the years is another reason. Last but not least, hope always springs eternal.

Roberto Plaja, February 21, 2022

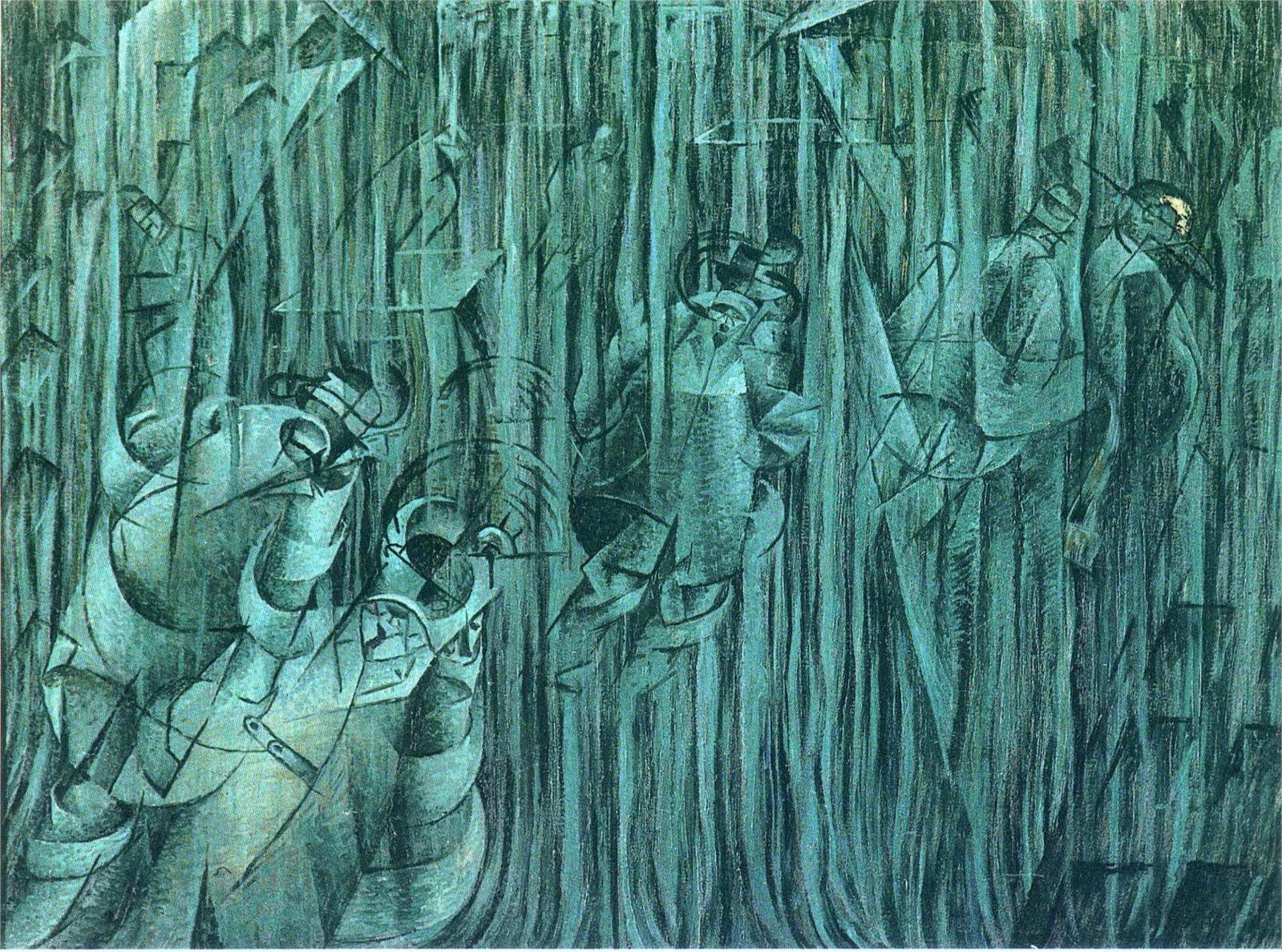

Cover: Umberto Boccioni, ‘States of Mind III; Those Who Stay’ (‘Stati d’animo III: Quelli che restano’), 1911; https://fr.wikipedia.org/wiki/Fichier:States_of_Mind_III;_Those_Who_Stay,_by_Umberto_Boccioni,_1911.jpg